Owning a Home Helps Protect Against Inflation

You’re probably feeling the impact of high inflation every day as prices have gone up on groceries, gas, and more. If you’re a renter, you’re likely experiencing it a lot as your rent continues to rise. Between all of those elevated costs and uncertainty about a potential recession, you may be wondering if it still makes sense to buy a home today. The short answer is – it does. Here’s why.

The body content Homeownership actually shields you from the rising costs inflation brings.

Freddie Mac explains how:

“Not only will buying today help you begin to build equity, a fixed-rate mortgage can stabilize your monthly housing costs for the long-term even while other life expenses continue to rise – as has been the case the past few years.”

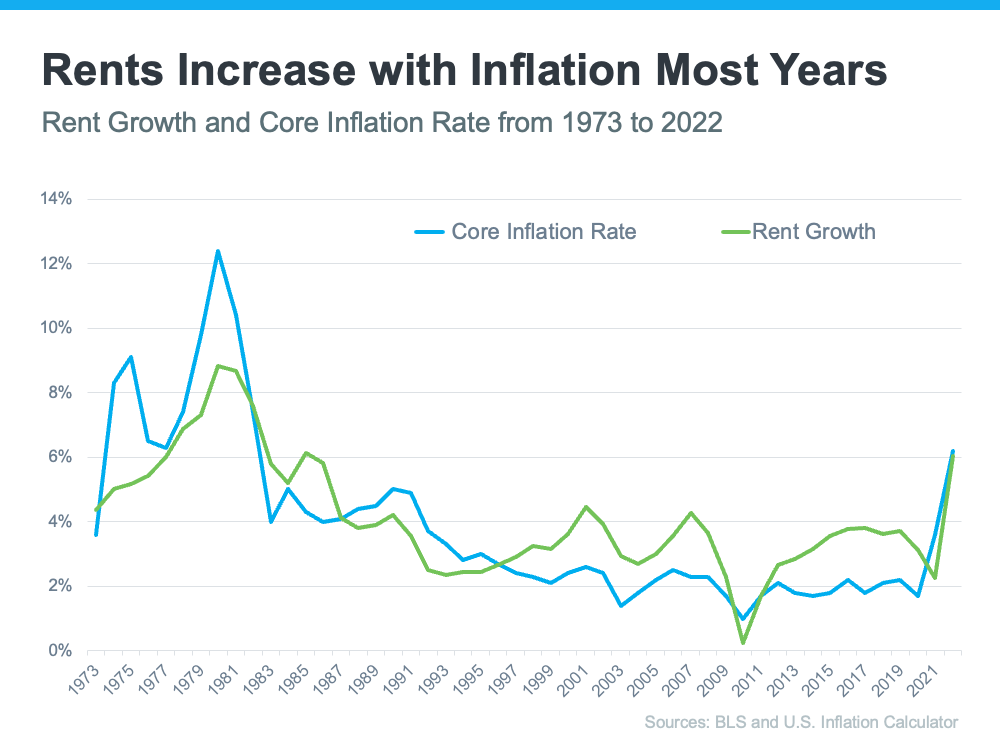

Unlike rents, which tend to rise with time, a fixed-rate mortgage payment is predictable over the life of the mortgage (typically 15 to 30 years). And, when the cost of most everything else is rising, keeping your housing payment stable is especially important.

The alternative to homeownership is renting – and rents tend to move alongside inflation. That means as inflation goes up, your monthly rent payments tend to go up, too (see graph above).

A fixed-rate mortgage allows you to protect yourself from future rent hikes. With inflation still high, when your rental agreement comes up for renewal, your property manager may decide to increase your payments to offset the impact of inflation. Maybe that’s why, according to a recent survey, 73% of property managers plan to raise rents over the next two years.

Having your largest monthly expense remain stable in a time of economic uncertainty is a major perk of homeownership. If you continue to rent, you don’t have that same benefit and aren’t as protected from rising costs.

Bottom Line:

A stable housing payment is especially important in times of high inflation. Let’s connect so you can learn more and start your journey to homeownership today! Contact us today!

If you are thinking of buying, selling, renting your home, or leasing real estate this year we’d love to hear from you! Working with experienced professionals can boost your profits!

Acuity Group

564 Dodge Ave. Suite A

Elk River, MN 55330

763-633-3535

OUR SPECIALTIES: Residential & Commercial Seller and Buyer Services, Senior Real Estate Specialist, Association Management Services, Property Management Services, Residential Rentals, Residential and Commercial Investment Property Specialists, New Construction, Listing & Marketing Specialists, CDPE (Certified Distressed Property Experts), Short Sale Specialists, REO/Bank Owned Sales. Golf Course Properties, Waterfront Property, Acreage and Farms, Vacant Land, Condos and Townhomes, Industrial/Manufacturing/Retail Properties, Association-Maintained Properties, Senior Housing, Luxury Homes, Vacation and Secondary Housing.

Serving the following Minnesota Counties: Sherburne, Anoka, Wright, Hennepin and portions of Mille Lacs and Isanti Counties

Contact Us

We will get back to you as soon as possible.

Please try again later.